Investors have closely watched Nvidia’s week-long GPU Technology Conference (GTC) for news and updates from the dominant maker of chips that power artificial intelligence applications.

The event comes at a pivotal time for Nvidia shares. After two years of monster gains, the stock is down 15% over the past month and 22% below the January all-time high.

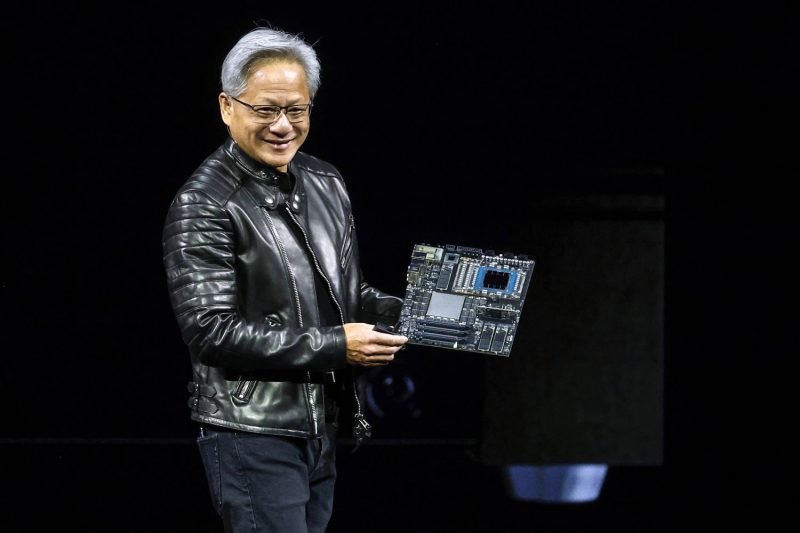

As part of the event, CEO Jensen Huang took questions from analysts on topics ranging from demand for its advanced Blackwell chips to the impact of Trump administration tariffs. Here’s a breakdown of how Huang responded — and what analysts homed in on — during some of the most important questions:

Huang said he “underrepresented” demand in a slide that showed 3.6 million in estimated Blackwell shipments to the top four cloud service providers this year. While Huang acknowledged speculation regarding shrinking demand, he said the amount of computation needed for AI has “exploded” and that the four biggest cloud service clients remain “fully invested.”

Morgan Stanley analyst Joseph Moore noted that Huang’s commentary on Blackwell demand in data centers was the first-ever such disclosure.

“It was clear that the reason the company made the decision to give that data was to refocus the narrative on the strength of the demand profile, as they continue to field questions related to Open AI related spending shifting from 1 of the 4 to another of the 4, or the pressure of ASICs, which come from these 4 customers,” Moore wrote to clients, referring to application-specific integrated circuits.

Piper Sandler analyst Harsh Kumar said the slide was “only scratching the surface” on demand. Beyond the four largest customers, he said others are also likely “all in line looking to get their hands on as much compute as their budgets allow.”

Another takeaway for Moore was the growth in physical AI, which refers to the use of the technology to power machines’ actions in the real world as opposed to within software.

At previous GTCs, Moore said physical AI “felt a little bit like speculative fiction.” But this year, “we are now hearing developers wrestling with tangible problems in the physical realm.”

Truist analyst William Stein, meanwhile, described physical AI as something that’s “starting to materialize.” The next wave for physical AI centers around robotics, he said, and presents a potential $50 trillion market for Nvidia.

Stein highliughted Jensen’s demonstration of Isaac GR00T N1, a customizable foundation model for humanoid robots.

Several analysts highlighted Huang’s explanation of what tariffs mean for Nvidia’s business.

“Management noted they have been preparing for such scenarios and are beginning to manufacture more onshore,” D.A. Davidson analyst Gil Luria said. “It was mentioned that Nvidia is already utilizing [Taiwan Semiconductor’s’] Arizona fab where it is manufacturing production silicon.”

Bernstein analyst Stacy Rasgon said Huang’s answer made it seem like Nvidia’s push to relocate some manufacturing to the U.S. would limit the effect of higher tariffs.

Rasgon also noted that Huang brushed off concerns of a recession hurting customer spending. Huang argued that companies would first cut spending in the areas of their business that aren’t growing, Rasgon said.